Enhance Your Financial Preparation with Offshore Trust Services

Charting New Horizons: Increasing Your Wide Range Monitoring Profile With Offshore Trust Services

The Advantages of Offshore Trust Fund Providers in Riches Monitoring

You'll be impressed at the benefits of offshore depend on services in wealth administration. Offshore depend on services provide a wide array of benefits that can considerably boost your wide range management portfolio.

Secondly, overseas depend on solutions offer improved privacy. Unlike traditional onshore counts on, offshore trusts offer a higher degree of privacy and discretion. This can be specifically beneficial for people who value their monetary privacy and desire to maintain their properties far from spying eyes.

Furthermore, offshore trust funds provide tax advantages. Numerous offshore jurisdictions supply favorable tax obligation regimes, enabling people to lawfully lower their tax obligations. By utilizing overseas depend on services, you can lessen your tax obligation responsibilities and preserve a larger part of your wealth.

Furthermore, offshore trust funds enable international diversification. By purchasing international markets and holding assets in various territories, you can spread your danger and possibly raise your financial investment returns. This diversification technique can help you accomplish long-lasting monetary growth and stability.

Trick Factors To Consider for Including Offshore Depends On Into Your Portfolio

When including overseas trust funds into your investment method, it is necessary to consider vital aspects. Offshore counts on can use many benefits, such as property defense, tax obligation benefits, and personal privacy. Prior to diving right into this type of financial investment, you need to thoroughly analyze your goals and goals.

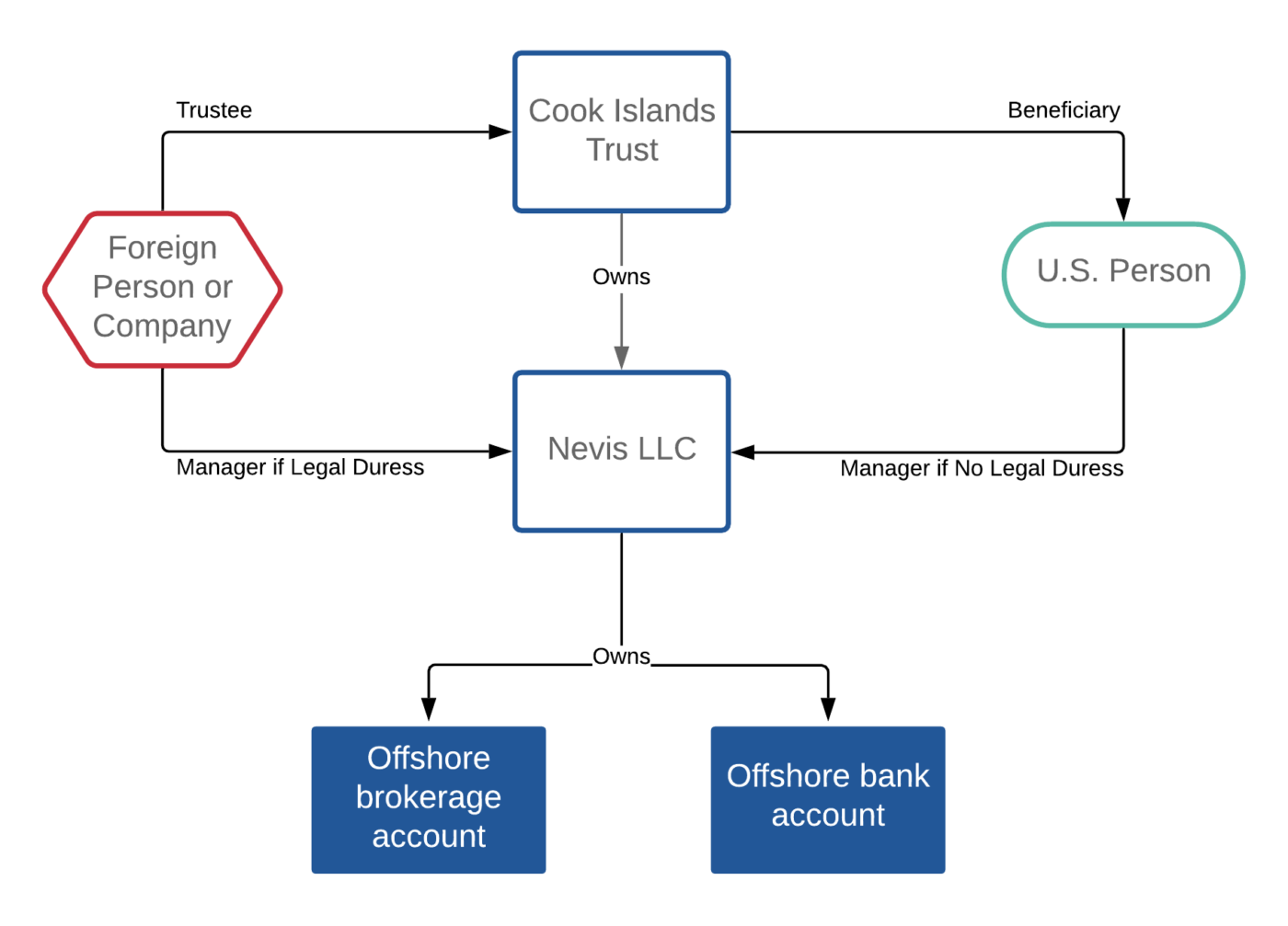

First of all, it's important to choose the best jurisdiction for your offshore count on. Various countries have different laws and policies, so you require to locate a territory that straightens with your specific requirements. You need to think about elements such as political security, lawful framework, and online reputation.

Secondly, you ought to completely research and choose a reliable trustee to handle your overseas trust fund. The trustee plays a crucial duty in safeguarding and administering your assets. Seek a trustee with a strong performance history, know-how in overseas trust fund management, and strong economic security.

In addition, you need to understand the coverage needs and tax effects related to overseas counts on. It's vital to conform with all appropriate regulations and policies to prevent any legal issues or penalties in your home nation.

Last but not least, it's necessary to frequently evaluate and monitor your overseas trust to ensure it stays aligned with your financial investment objectives. Economic and political changes can influence the performance of your count on, so staying informed and proactive is critical.

Exploring International Jurisdictions for Offshore Trust Services

Picking the ideal jurisdiction is vital when discovering international choices for offshore trust funds. With so several nations offering offshore count on solutions, it is essential to take into consideration various factors before making a decision.

One more important factor to consider is the tax obligation advantages used by the jurisdiction. Various nations have various tax laws and policies, and some might use more favorable tax prices or exemptions site web for overseas depends on. By very carefully evaluating the tax implications of each territory, you can maximize your wide range and lessen your tax obligations.

Ultimately, take into consideration the ease of doing organization in the territory. Try to find nations with strong financial framework, efficient governing frameworks, and a supportive service environment.

Making The Most Of Tax Obligation Effectiveness With Offshore Depend On Structures

Optimizing tax obligation performance can be accomplished with offshore trust frameworks that provide positive tax obligation prices and exceptions. By developing an offshore trust, you can strategically handle your wealth and decrease your tax obligation liabilities. Offshore territories often supply eye-catching tax rewards, such as lower or zero tax rates on revenue, resources gains, and inheritance. This allows you to retain more of your wide range and possibly expand it even more.

Among the key benefits of overseas trust funds is the capacity to delay tax obligations. By putting your properties in a trust, you can delay the settlement of tax obligations until a later date and even avoid them altogether in some instances. This can be especially valuable for people with substantial financial investment revenue or those that expect future tax obligation increases.

Furthermore, offshore trust funds supply a degree of privacy and asset defense that you might not discover in your house jurisdiction. By This Site positioning your possessions in an overseas trust fund, you can shield them from possible financial institutions and lawful conflicts. This can give comfort and protect your wide range for future generations.

It is essential to note that while offshore trust funds supply tax benefits, it is crucial to comply with all appropriate tax regulations and laws. offshore trust services. Dealing with skilled experts that concentrate on offshore depend on structures can ensure that you make the most of tax obligation efficiency while remaining fully compliant with the regulation

Mitigating Danger and Enhancing Asset Protection With Offshore Depends On

To reduce risk and enhance property security, you can depend on offshore depends on, which offer a degree of personal privacy and legal protection that may not be readily available in your house jurisdiction. Offshore trust funds supply a calculated solution for securing your wide range by positioning your assets in a separate legal entity beyond your home nation. By doing so, you can protect your assets from potential financial institutions, suits, and other dangers.

Among the primary advantages of utilizing offshore depends on is the degree of personal privacy they manage. Unlike in your home jurisdiction, where your economic details may be quickly accessed by federal government authorities or various other interested events, offshore trust funds supply a higher level of privacy. Your individual and financial details are maintained confidential, allowing you to keep a greater degree of control over your properties.

In addition, overseas trusts can offer enhanced possession protection. In case of litigation or monetary troubles, having your possessions in an offshore depend on can make it harder for creditors to reach them. The trust works as an obstacle, offering an added layer of defense and making it harder for anybody looking for to take your possessions.

In addition to privacy and property security, offshore trusts can additionally use tax advantages, which better add to your total risk reduction approach. By carefully structuring your depend on, you can potentially minimize your tax obligations and enhance your estate planning.

Verdict

To conclude, by integrating overseas count on services right into your wide range monitoring portfolio, you can appreciate many advantages such as tax efficiency, asset defense, and accessibility to international jurisdictions. It is necessary to carefully take into consideration crucial elements when selecting offshore trusts, such as credibility, regulatory framework, and specialist competence. With appropriate preparation and support, you can expand your financial investment perspectives and protect your riches in a globalized world. Do not miss out on out on the opportunities that offshore depend on solutions can use to grow and safeguard your site here wide range.

Unlike standard onshore depends on, offshore counts on supply a higher level of privacy and privacy. Offshore trusts can use countless advantages, such as asset security, tax benefits, and privacy. Different countries have various tax obligation legislations and policies, and some might supply extra beneficial tax rates or exceptions for offshore depends on.Making the most of tax performance can be attained through overseas trust fund frameworks that supply beneficial tax obligation rates and exceptions.In final thought, by incorporating offshore trust fund services right into your riches monitoring profile, you can delight in many benefits such as tax obligation performance, possession security, and access to international jurisdictions.